Información sobre petróleo, gas,

- Details

- Category: Energía y Combustibles

- Published on Thursday, 03 March 2022 06:53

- Written by Administrator2

- Hits: 744

https://www.worldometers.info/gas/gas-reserves-by-country/

http://www.aukevisser.nl/supertankers/gas-SP/id703.htm

Flota de petroleros

Según Statista, la capacidad de la flota mundial de petroleros aumentó significativamente entre 1980 y 2020 en más del 77 %. A pesar de la creciente contribución de las energías renovables al consumo mundial de energía, el mercado mundial sigue dependiendo en gran medida del petróleo. En 2020, la flota mundial de petroleros tenía un peso muerto de aproximadamente 601 millones de toneladas. Los distintos tipos de petroleros se clasifican por tamaño de flota: VLCC, Suezmax y Aframax. A partir de abril de 2020, la flota global incluía 810 petroleros de gran tamaño. Dado que el petróleo es la fuente de energía más utilizada, la creciente demanda de energía está impulsando la extracción y el transporte de petróleo.

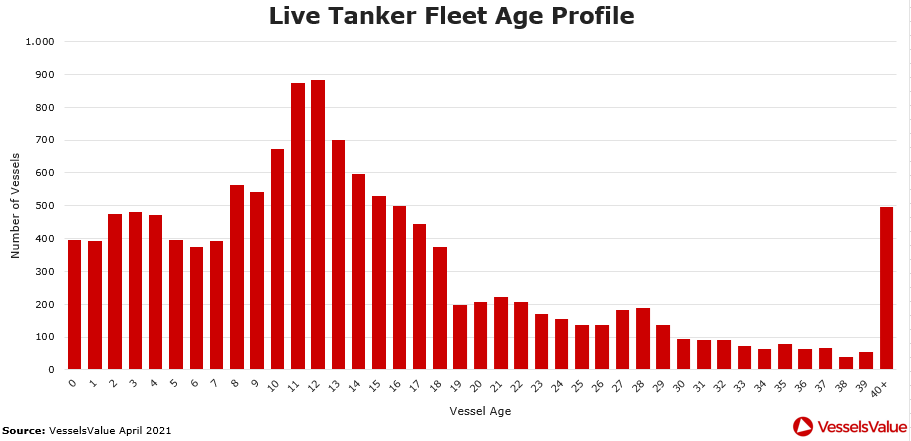

Una flota con un 25% de buques de más de 20 años de antigüedad

Offshore energy

One quarter of tanker fleet to be over 20 years old by 2023

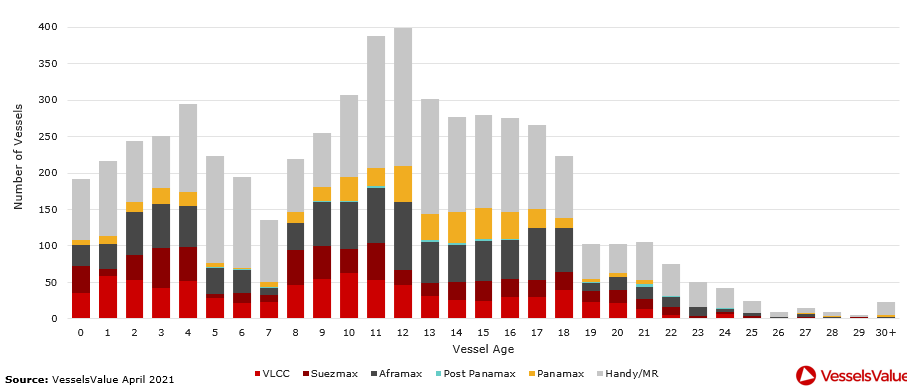

More than 25% of the active tanker fleet, i.e., one quarter, is set to reach 20 years of age by 2023, creating quite a scrapping candidate list going forward.

Data from VesselsValue shows that of the 13, 211 tankers in its data base, including small tankers, over 3,000 are 20 years old and older.

Coupled with over 570 ships that are currently 18 and 19 years old, the estimate is on point, should low scrapping activity continue to prevail.

With regard to the age profile of tankers of 18+ years, Handy/MR tankers account for the biggest share, followed by VLCCs and Aframax and Suezmax tankers.

Dwindling oil demand caused by the COVID-19 pandemic was expected to reduce the global tanker capacity, as owners were predicted to demolish some of their older tonnage bringing some ease to the market.

The scrapping activity has been greatly impacted by the pandemic as outbreaks and governmental measures shut down shipbreaking operations in Asia.

However, there seem to be some positive developments as old vessel supply has begun to respond to higher steel prices, and scheduled environmental regulations prompting an increase in vessel recycling albeit from very low levels, according to Euronav.

Although demolitions are up from the start of last year, only two shuttle tankers and two Aframax crude oil carriers (0.45 million DWT) have been confirmed demolished in the first two months of 2021, according Clarksons’ data.

This is significantly down from the 1.1 million dwt of crude oil tanker

the capacity that left the market in December 2020, BIMCO’s data shows.

https://gtt.fr/references-partners/built-vessels

https://seekingalpha.com/article/4492353-

us-natural-gas-is-headed-to-3